Optimizing Your Crypto Selling Strategy for Maximum Profits

When the cryptocurrency market is on a bullish trend, it can be tempting to hold onto your assets indefinitely. However, data often suggests that it’s wise to consider selling before a potential market downturn.

Key Signals to Watch Before Selling

Smart sellers pay close attention to a variety of signals across different categories:

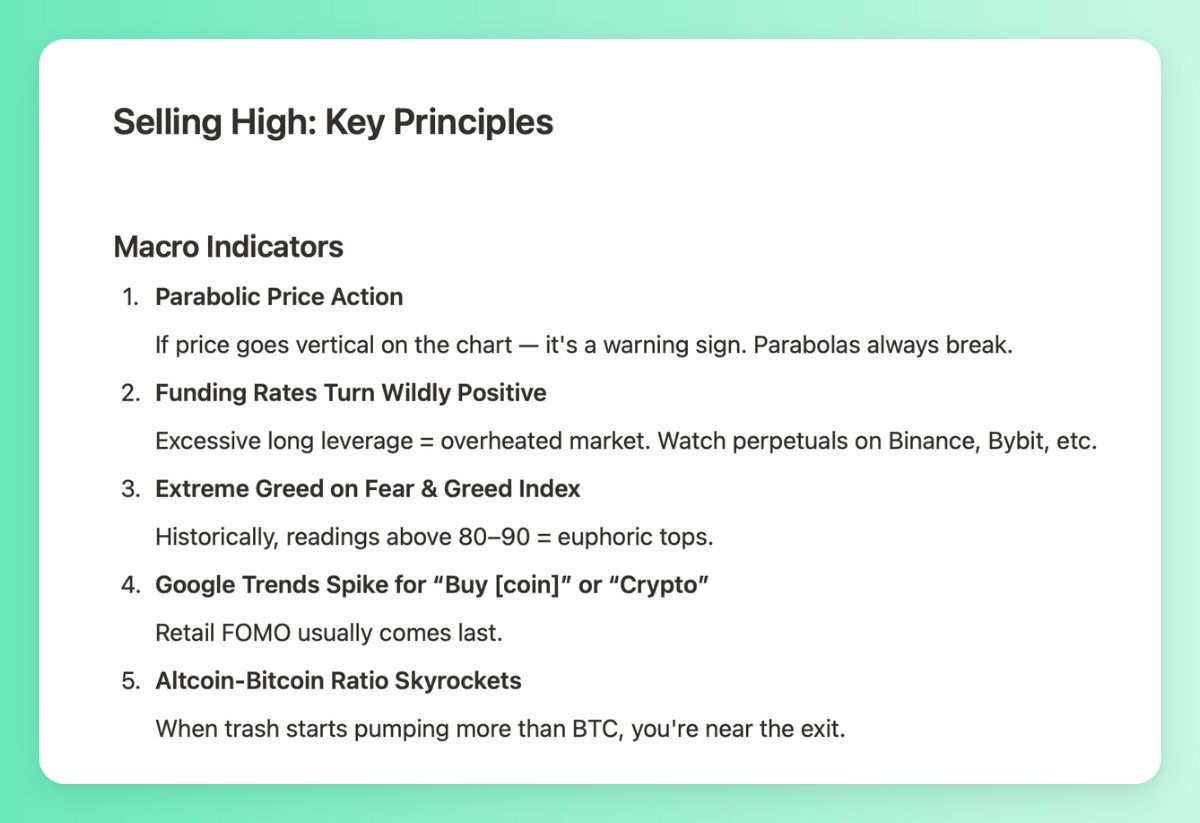

- Macro Signals: Keep an eye on parabolic charts, overheated funding, high retail interest, and a greed index reading in the 80–90 zone.

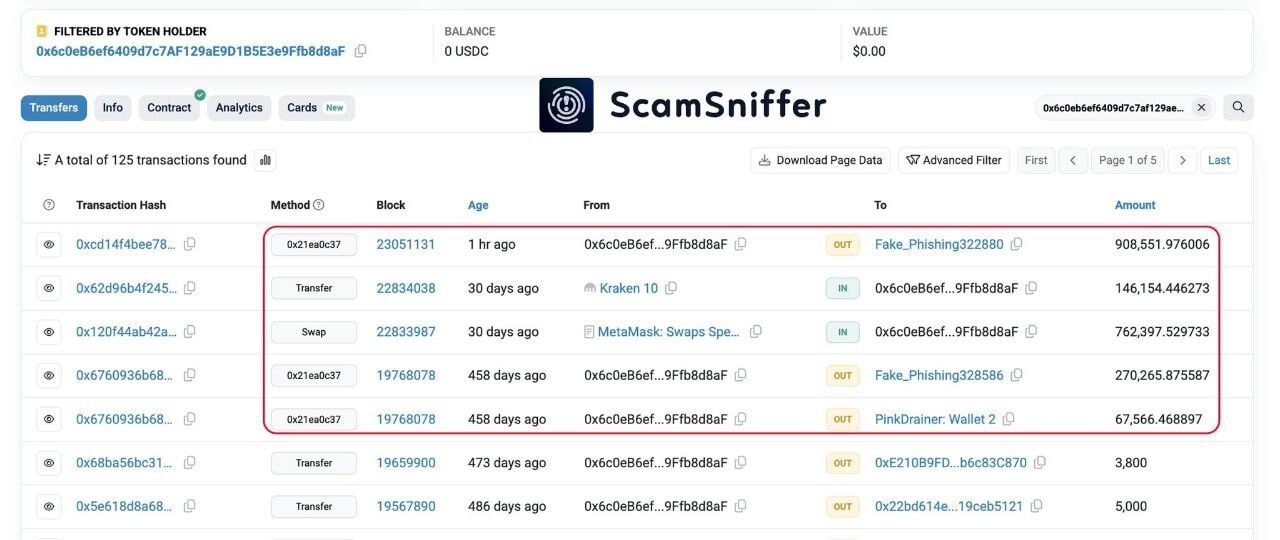

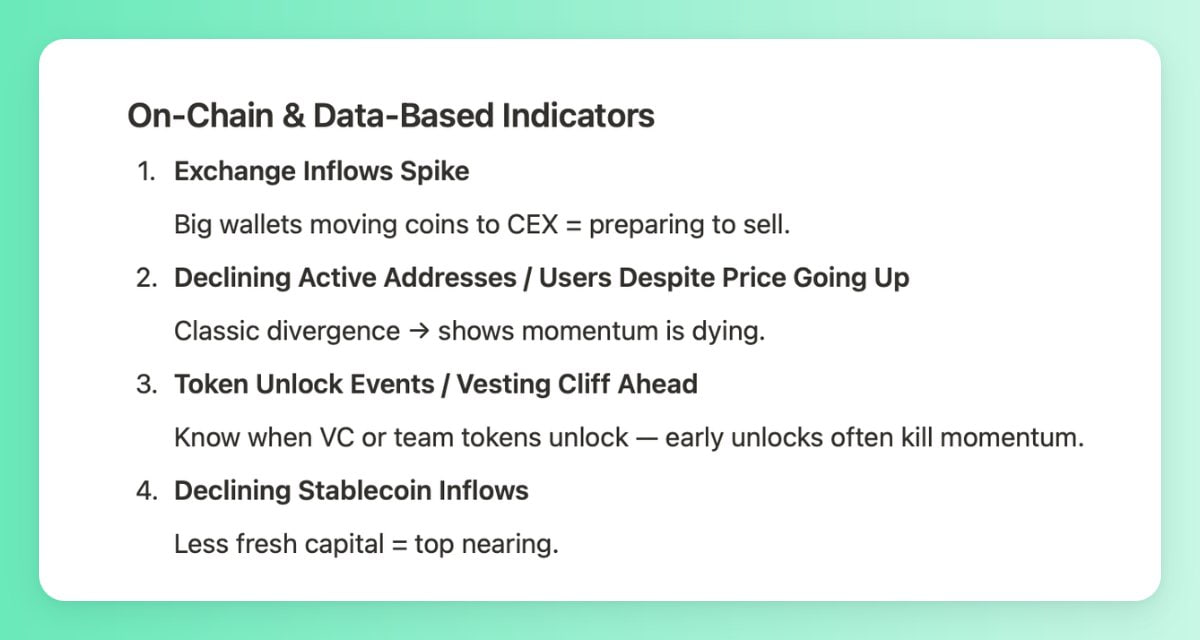

- Onchain Indicators: Monitor whale movements to centralized exchanges (CEXs), observe weak user growth, track unlock schedules, and watch for decreases in stablecoin inflows.

- Social Cues: Be cautious if inexperienced investors start asking how to buy, watch out for viral slogans, be wary of sudden pumps in low-value coins, and be skeptical of overly optimistic posts from project teams.

- Execution Tips: Plan your exit points in advance, consider selling in stages instead of all at once, avoid shifting investments into low-quality projects, maintain a rational approach, and question the valuations of different sectors within the crypto market.

It’s crucial not to aim for selling at the exact peak. Define your selling strategy before emotions like euphoria kick in, and safeguard the capital that you’ve worked hard to accumulate over the years.

Check out also: July Crypto Launch Recap: Overview of Recent Projects