Crypto Venture Weekly: September 1–5, 2025

$185M raised across 22 projects this week, led by Etherealize ($40M) and Utila ($22M).

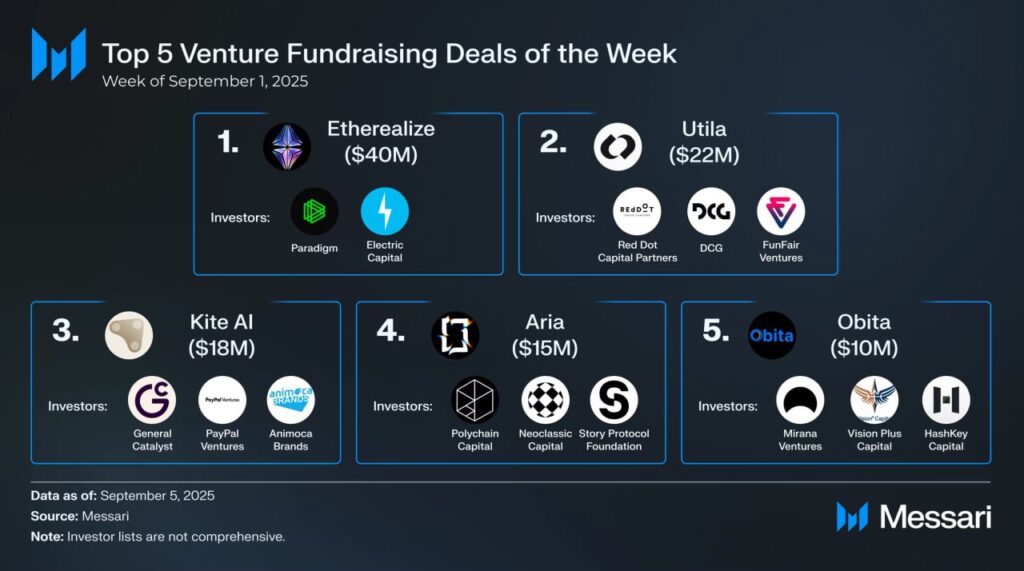

Top Funding Highlights

TRON Inc. added $110M to its TRX treasury, while CIMG Inc. acquired 500 BTC ($55M).

Merger and Acquisition News

M&A saw Kraken acquire Breakout, Solowin buy AlloyX for $350M, and RedStone purchase Credora. Sora Ventures launched a $1B Bitcoin Treasury Fund.

Top 10 Projects Overview

- Etherealize ($40M, Paradigm, Electric Capital): Institutional marketing and product arm for Ethereum.

- Utila ($22M, Red Dot, DCG, FunFair, Nyca Partners): All-in-one digital asset operations platform for institutions.

- Kite AI ($18M, General Catalyst, PayPal Ventures, Animoca, HashKey, GSR, Hashed): A purpose-built L1 blockchain for AI applications.

- Aria ($15M, Polychain, Neoclassic, Story Protocol Foundation): IP tokenization platform built on Story Protocol.

- Obita ($10M, Mirana Ventures, Vision Plus, HashKey, Web3.com Ventures): Global B2B financial infrastructure and digital finance network.

- Plural ($7.13M, Paradigm, Maven 11, Volt, Neoclassic): Tokenizing solar, storage, batteries, and data centers.

- Reflect ($3.75M, a16z CSX, Big Brain, Solana Ventures, Colosseum, Equilibrium): Yield-bearing stablecoin protocol built on Solana.

- Wildcat Finance ($3.5M, Robot Ventures, P2 Ventures, Kronos Research, Hyperithm): Configurable undercollateralized credit rails on Ethereum.

- Maiga ($2M, Amber Group, Red Beard, IBC, Chainlink): Decentralized AI agent and DeFAI platform on BNB Chain.

- Gigaverse ($1M, 1Confirmation): A Web3 role-playing game live on Abstract.

Investor Focus

Investor focus this week was on stablecoin infrastructure, AI-powered DeFi, and tokenized assets, while treasuries and M&A reshaped the landscape.

Explore next: Altcoins in Crypto Trading: 5 Reasons Why They Matter