Crypto Venture Weekly: August 25–29, 2025

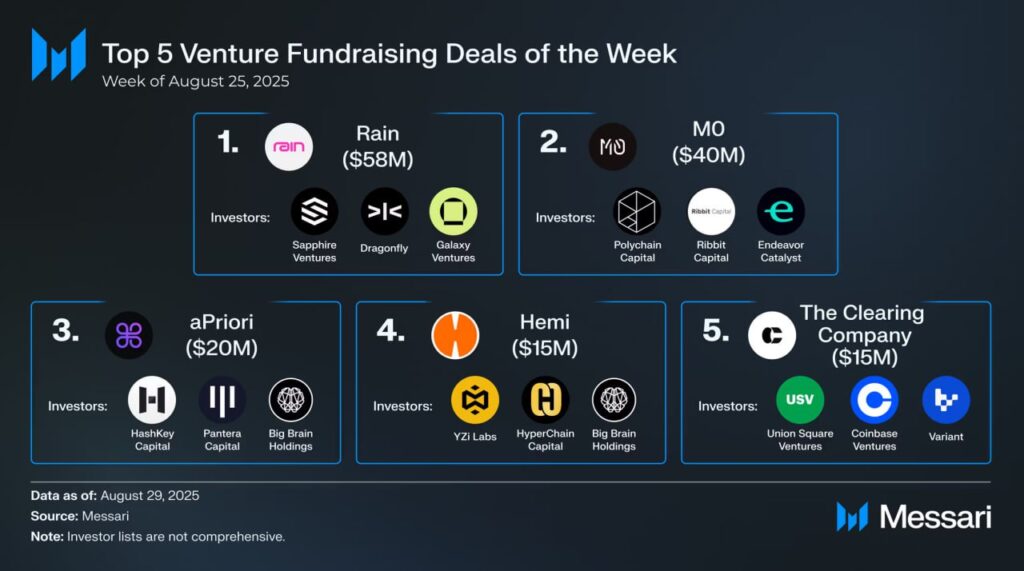

$255M raised across 30 projects this week, led by Rain ($58M) and M0 ($40M). Alongside, $1.53B in new digital asset treasury allocations were announced by B Strategy, Sharps Technology, and DeFi Development Corp. Avail acquired Arcana, while OKX and Unified Ventures launched $130M in fresh funds.

Top 10 Projects Overview

- Rain ($58M, Sapphire, Dragonfly, Galaxy, Lightspeed Faction, Samsung Next)

- M0 ($40M, Polychain, Ribbit, Endeavor Catalyst, Pantera, Bain Crypto)

- aPriori ($20M, HashKey, Pantera, Big Brain, Primitive, Gate Ventures)

- Hemi ($15M, YZi Labs, Republic, HyperChain, Big Brain, Crypto.com)

- The Clearing Company ($15M, USV, Coinbase, Variant, Haun, Compound)

- MAGNE.AI ($10M, DuckDAO, Castrum, Becker Ventures, TBV)

- Kira ($6.7M, Stellar, Blockchange, Credibly Neutral, Grit Capital)

- Metafyed ($5.5M, Stellar, Draper U Ventures, Cyberport, Zero2Launch)

- Credit Coop ($4.5M, Maven 11, Faction, Coinbase, TRGC, dlab)

- Suzaku Network ($1.5M, Blizzard Fund, Avalanche Foundation, Yield Yak)

Enterprise-grade infrastructure for stablecoin payments.

Universal platform for application-specific stablecoins.

Order flow coordination layer for high-performance blockchains.

EVM-level programmability layer for Bitcoin.

Onchain, permissionless, and regulated prediction market.

AI + Web3 hardware project building decentralized smartphones.

AI-driven DeFi infra for embedded fintech products.

Marketplace for tokenized real-world assets.

Onchain credit protocol backed by cash flows.

Restaking protocol on Avalanche.

Investor focus this week was on stablecoin infrastructure, AI-powered DeFi, and RWA marketplaces, while treasuries and M&A kept reshaping the landscape.

Don’t miss: Cryptocurrency Trading: The Most Significant Error Revealed by CZ