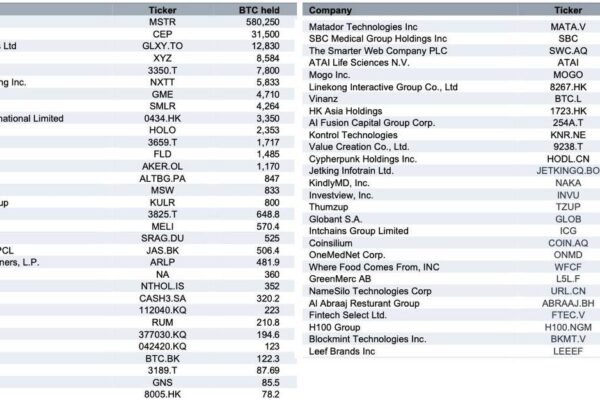

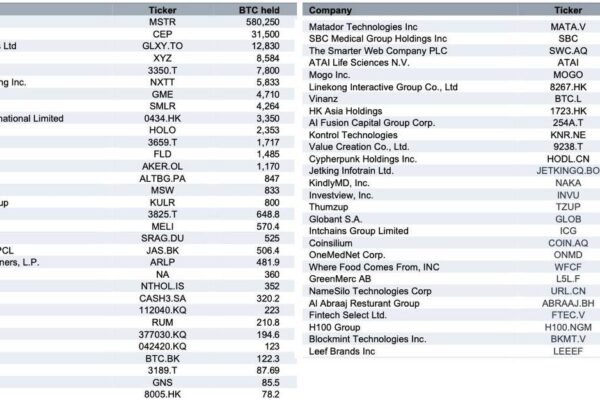

Corporate BTC holdings top 3% of total supply

Corporate BTC holdings top 3% of total supply A decade ago, most firms ignored or dismissed Bitcoin. Today, corporate treasuries collectively hold over 3% of all $BTC — and the number keeps rising.

Stay updated with the latest cryptocurrency news, Bitcoin and altcoin price movements, and major blockchain developments. Our 24/7 coverage delivers breaking updates, expert insights, and real-time market reactions from the crypto world.

Corporate BTC holdings top 3% of total supply A decade ago, most firms ignored or dismissed Bitcoin. Today, corporate treasuries collectively hold over 3% of all $BTC — and the number keeps rising.

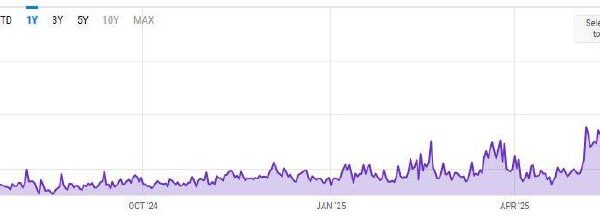

BNBChain daily transactions have surged since April Network activity is accelerating rapidly, with daily transactions climbing to multi-month highs. Momentum suggests rising user engagement and sustained demand.

🔔 Crypto Market Alerts 🔔 📅 Report Date: 2025-06-09 📊 This report is based on the analysis of the previous day’s data. 🕒 The analysis includes daily candlesticks from Binance. 📈 Signals for Today: ➤ 📊 Sell Signal for ETH/USDT – 2025-06-08 The SMA7 line crossed below the SMA28 line. This may indicate the beginning…

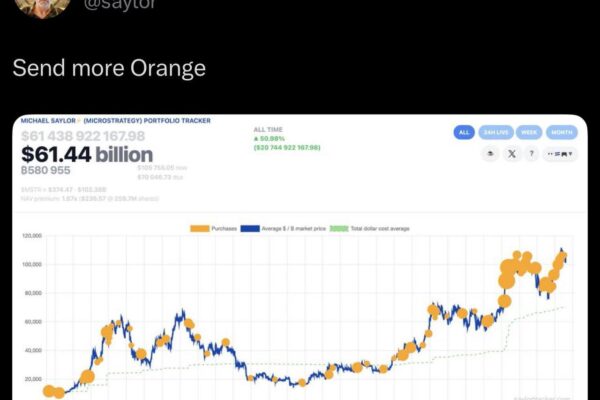

Saylor hints that MicroStrategy has been buying $BTC this week.

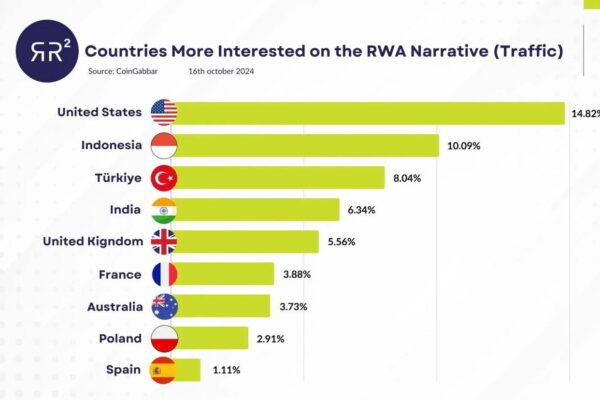

RWA interest continues to grow globally. This sector is expected to top $15 Trillion by 2030

🔔 Crypto Market Alerts 🔔 📅 Report Date: 2025-06-08 📊 This report is based on the analysis of the previous day’s data. 🕒 The analysis includes daily candlesticks from Binance. 📈 Signals for Today: ➤ 📊 Sell Signal for BNB/USDT – 2025-06-07 The SMA7 line crossed below the SMA28 line. This may indicate the beginning…

CZ rephrased a famous quote by Winston Churchill.

The SFC will allow professional investors to trade crypto derivatives — a major policy shift. In Q1 alone, derivatives volume hit $21T, dwarfing $4.6T in spot trading (TokenInsight).

Tim Draper: Bitcoin could hit $250K this year — or even go infinite against the dollar as institutional demand, banks, and Web3 adoption pick up speed.

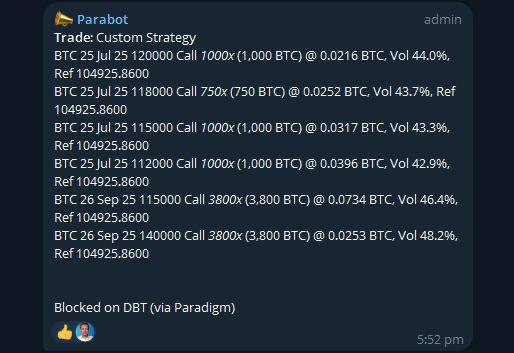

A trader bought a massive batch of BTC call options, paying $50M in premiums. These options give the right to buy BTC at specific prices on set dates — and they’re ultra-bullish: Is this a bet on $120K BTC by late July — and $140K by September?