Institutional buying spree for ETH

Institutional buying spree for ETH ETH ETF inflows have risen for 3 straight weeks — signaling renewed institutional interest. Over the past two weeks alone, inflows totaled $1.1B.

Stay updated with the latest cryptocurrency news, Bitcoin and altcoin price movements, and major blockchain developments. Our 24/7 coverage delivers breaking updates, expert insights, and real-time market reactions from the crypto world.

Institutional buying spree for ETH ETH ETF inflows have risen for 3 straight weeks — signaling renewed institutional interest. Over the past two weeks alone, inflows totaled $1.1B.

Stablecoin continues to surge! Stablecoin market cap has hit an all-time high of $228B — up $33B in 2025 alone (+17%). Are stablecoins becoming the backbone of crypto markets?

Imagine being this guy That last 8500$ sell just 8 days ago would have been 1,3 million dollars today $aura

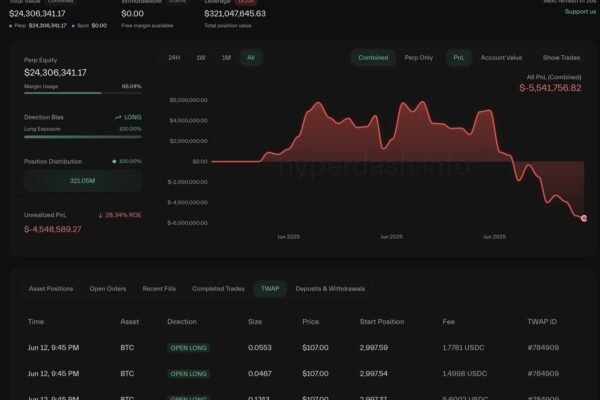

Mystery whale 0x1f25 revealed as AguilaTrades Over the past 4 days, Aguila moved 29.85M $USDC from Bybit to Hyperliquid to long $BTC. He’s currently down over $5.5M — but just doubled down on the position as BTC dipped again. https://hyperdash.info/trader/0x1f250Df59A777d61Cb8bd043c12970F3AFE4F925

This trader went from $492 to $47 million dollars in profit in just over 1 year. Everything is possible, don’t give up.

New CoinList Sale — Enso EnsoEnso is a cross-chain infrastructure project simplifying multichain app development. Already integrated with Uniswap, Stargate, LayerZero, CowSwap, zkSync, and others. Sale Details: • Date: June 12–19, 2025 • Price: $1.25 per token (FDV $125M) — 18% discount from previous $140M round • Raise: 4M $ENSO, 100% unlocked at TGE •…

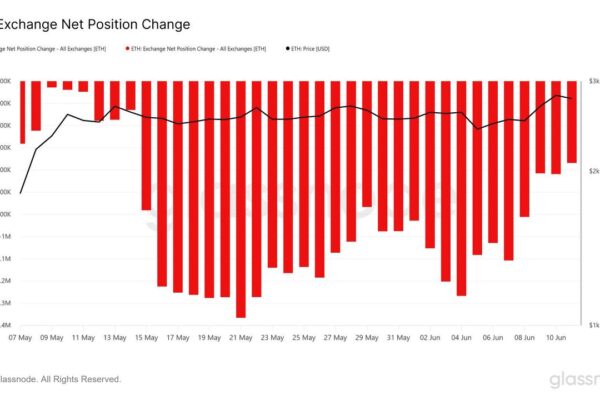

Eth supply shock incoming? ETH exchange balances on exchanges have dropped daily for over a month. Sustained outflows suggest a looming supply shock — with less ETH available to sell, increased demand could lead to a rally

$11.5 trillion BlackRock aims to become the world’s largest crypto asset manager by 2030

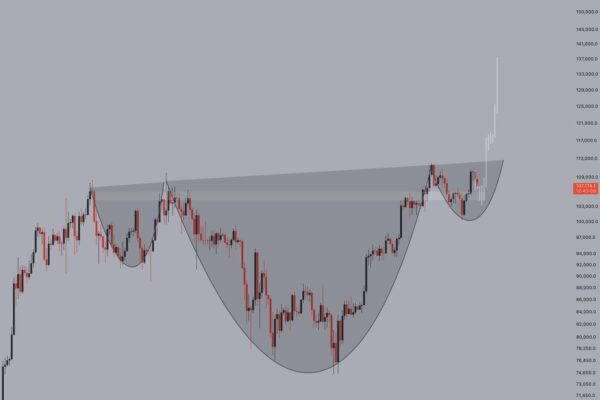

Bitcoin eyes breakout: Inverse H&S forming near ATH A textbook inverse head & shoulders pattern is shaping up just below Bitcoin’s all-time highs.

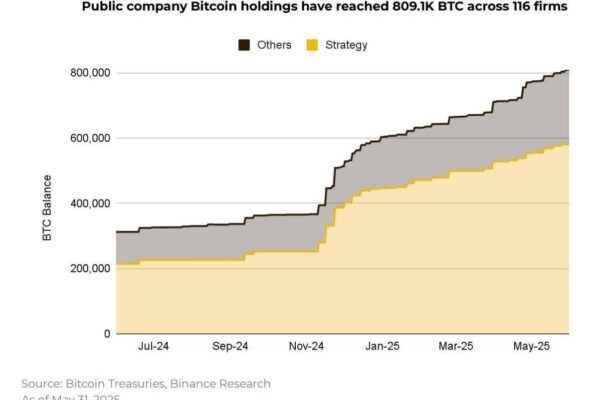

Public companies now hold over 800K BTC 116 public companies collectively hold 809,100 BTC — up from 312,200 just a year ago.