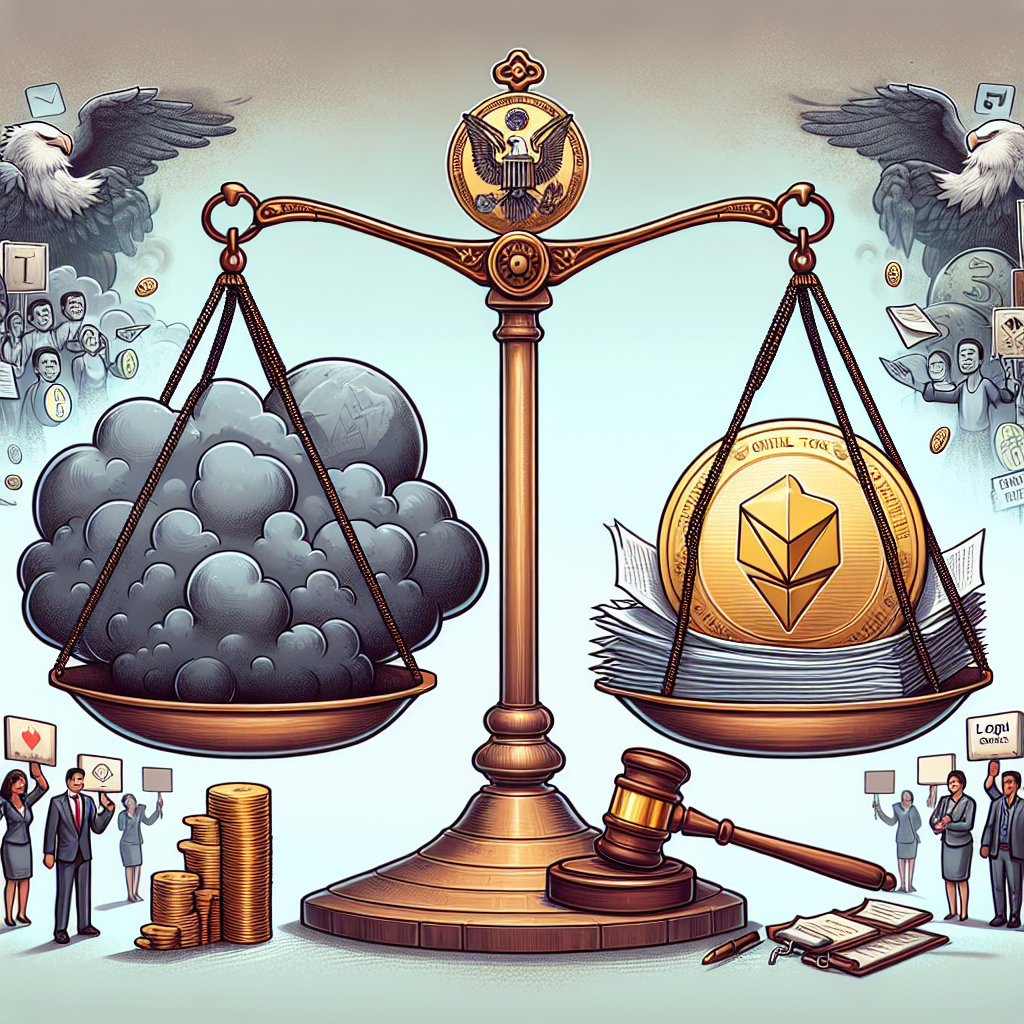

Ripple ETFs have been facing constant delays primarily due to regulatory uncertainty surrounding the XRP token. The Securities and Exchange Commission (SEC) has not provided clear guidelines on how XRP should be classified – as a security or a commodity. This lack of clarity has made it difficult for ETF issuers to get approval for XRP-based ETFs.

Additionally, Ripple Labs, the company behind XRP, has been embroiled in legal battles with the SEC over the alleged unregistered securities offerings. These ongoing legal issues have further added to the delays in approving XRP ETFs.

The XRP Army, a community of XRP supporters, believes that these delays are a result of a coordinated effort by regulators to stifle innovation and prevent XRP from gaining mainstream adoption. They argue that XRP is a decentralized digital asset with real-world utility, and that ETFs based on XRP would provide investors with a convenient way to gain exposure to the digital asset.

Overall, the delays in approving Ripple ETFs can be attributed to regulatory uncertainties and legal challenges surrounding XRP, as well as concerns raised by the XRP community regarding the motives behind these delays.

Check out also: Daily crypto report – 12.09.2025