Lessons Learned from Trader Ryzqq’s $180K Shorting Mistake

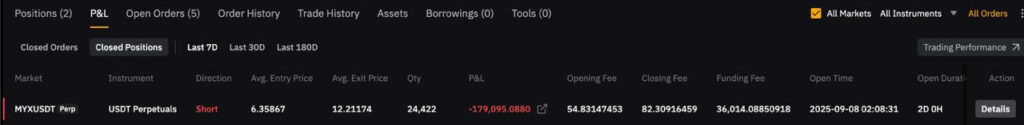

Trader Ryzqq recently experienced a significant setback, taking a $180K hit while shorting the scam token $MYX. Instead of concealing his loss, he bravely shared the valuable lessons he learned the hard way, which every trader eventually faces.

Key Takeaways:

- Never short a stock without a stop-loss in place. Small wins and losses are manageable, but significant losses can be detrimental.

- Avoid holding onto a position simply to break even. This type of trading is driven by hope, not strategy.

- Short positions should be infrequent as, over time, they tend to yield negative results.

- Maintain a list of “Do Not Touch” assets, including insider coins and potential scams. Remember, sometimes the best trade is no trade at all.

- If you can’t summarize your trading setup in two simple sentences, reconsider your strategy.

- Assuming something is a scam and will dump can be a dangerous mindset. Insiders may have already profited before the expected dump.

- Emphasize the importance of mental well-being in trading. Negative trades can impact your overall portfolio.

- Adopt an abundance mindset. Opportunities in the market are plentiful; you don’t have to trade every single one.

One crucial factor that saved Trader Ryzqq from further losses was keeping his position size small. However, his major error was holding onto the trade even after it lost its potential.

In the words of Druckenmiller, “I already knew I shouldn’t do it. I just couldn’t stop myself.”

Explore next: SharpLink Gaming Initiates $1.5B Buyback Program – Key Highlights