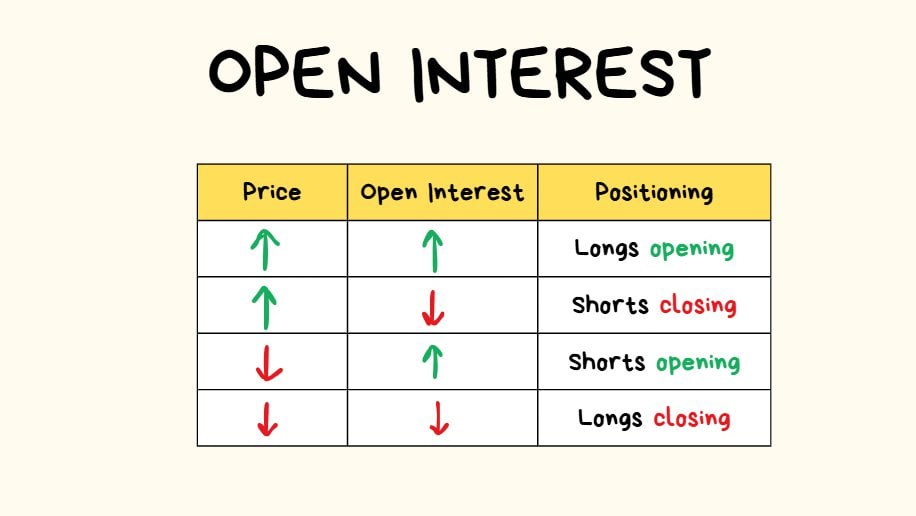

Understanding the Importance of Open Interest in Trading

Many traders often solely rely on charts to make trading decisions. However, delving into Open Interest (OI) can provide valuable insights into the market activity that charts might not reveal.

Rising OI Indicates Potential Trend Continuation

When Open Interest is on the rise, it typically suggests that the current trend is likely to continue rather than reverse. This information can help traders make more informed decisions.

Falling OI Implies Exit Pressure and Potential Traps

Conversely, a decrease in Open Interest indicates exit pressure in the market. Traders should be cautious as this situation could lead to traps and short squeezes, where the price unexpectedly spikes.

Utilizing OI Alongside Liquidations and Funding

By combining Open Interest data with insights on liquidations and funding rates, traders can better gauge the market’s actual conviction levels. This comprehensive analysis can provide a clearer picture of market sentiment.

While Open Interest is not a magical indicator on its own, when used in conjunction with market structure and positioning, it can significantly enhance a trader’s strategy and decision-making process.

You may also be interested in: Donald Trump’s Vision: United States to Become Global Hub for Bitcoin and Cryptocurrency