Insights from a $40M/month Trader Revealed

TheWhiteWhale, currently holding the second position on Hyperliquid’s leaderboard, has recently disclosed his comprehensive trading strategy, diverging from conventional approaches.

The Core Principles Guiding His Trades

- Apex Predator Behavior – The market is not arbitrary but influenced by tactics like trap-setting, liquidation hunts, and sentiment shifts. The decision-making of large investors outweighs that of retail traders.

- Technical Structure – While technical analysis (TA) such as breakouts and patterns is crucial, successful trades are often preceded by less obvious setups. TA is most effective when it coincides with the intentions of significant market players.

- Macro + Narrative – Factors like Federal Reserve rates, ETF movements, regulations, and market liquidity play a vital role. The narrative should complement the overall market scenario rather than dictate timing.

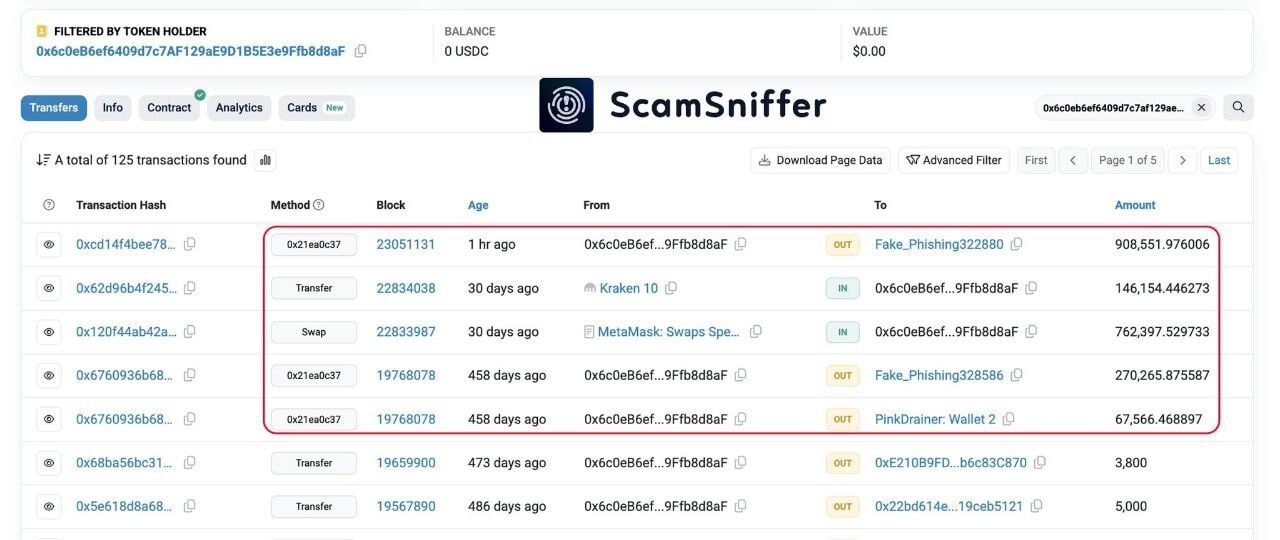

- On-chain + Whale Data – Utilizing data from liquidation maps, order books, and heatmaps is essential, but discerning whether the information signifies a trap or a defensive move is critical.

- Sentiment + Crowd Psychology – Examining funding rates, long/short ratios, and emotional market indicators helps in understanding the crowd’s sentiments. The trader focuses on anticipating outcomes if the majority is incorrect.

Execution Philosophy: The trader emphasizes that no single signal reigns supreme. He evaluates all the mentioned factors and acts when they align, exercising patience when they diverge.

While many traders seek certainty, TheWhiteWhale seeks conviction by converging multiple indicators.

Explore next: Daily crypto report – 29.07.2025