How Bitcoin Moves Throughout the Day: Sessions, VWAP, and Bias

Bitcoin (BTC) trades 24/7, but its price movement is not random. It follows a distinct rhythm. Understanding how to analyze daily price action using session logic, simple statistics, and key Volume Weighted Average Price (VWAP) zones can provide valuable insights.

The 4 Sessions

The day is divided into four sessions: Asia, London, New York, and Close. By observing the price in this segmented manner, traders can better identify market structure and bias. Each session adheres to fixed Coordinated Universal Time (UTC) to avoid confusion related to Daylight Saving Time changes.

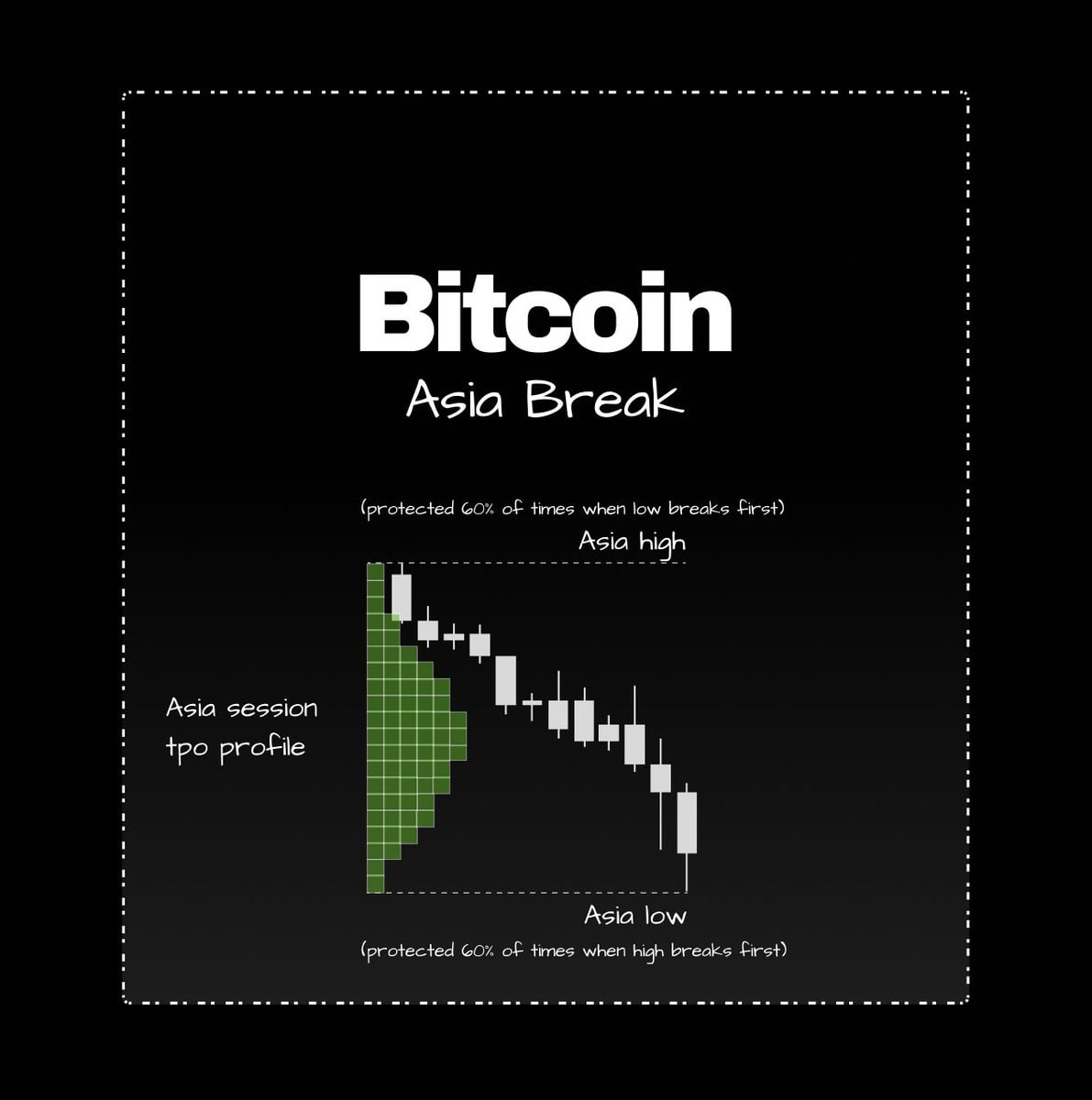

Asia Break as Intraday Bias

Approximately 60% of the time, the direction in which the Asia session breaks (either high or low) sets the tone for the rest of the day’s price movement. If Asia experiences an upward breakout, there is a high probability that New York will close at a higher price. This straightforward approach has proven to be remarkably effective.

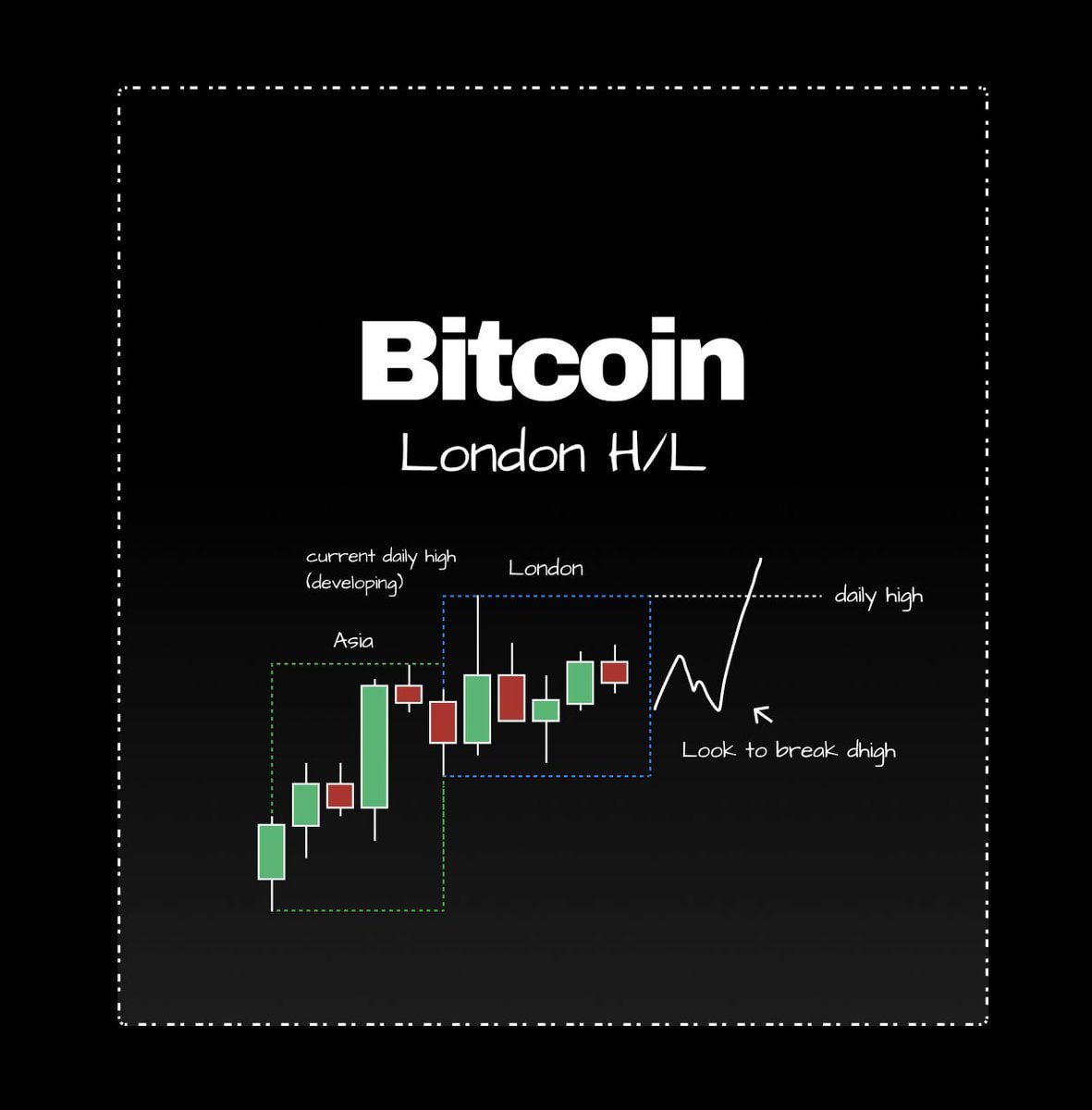

London Highs and Lows Are Meant to Be Taken

Merely 10–12% of the time, the highs or lows set during the London session represent the daily extremes for Bitcoin. Therefore, when London establishes a high or low, traders should anticipate that the price will revisit and potentially surpass these levels later in the day, rather than holding within that range.

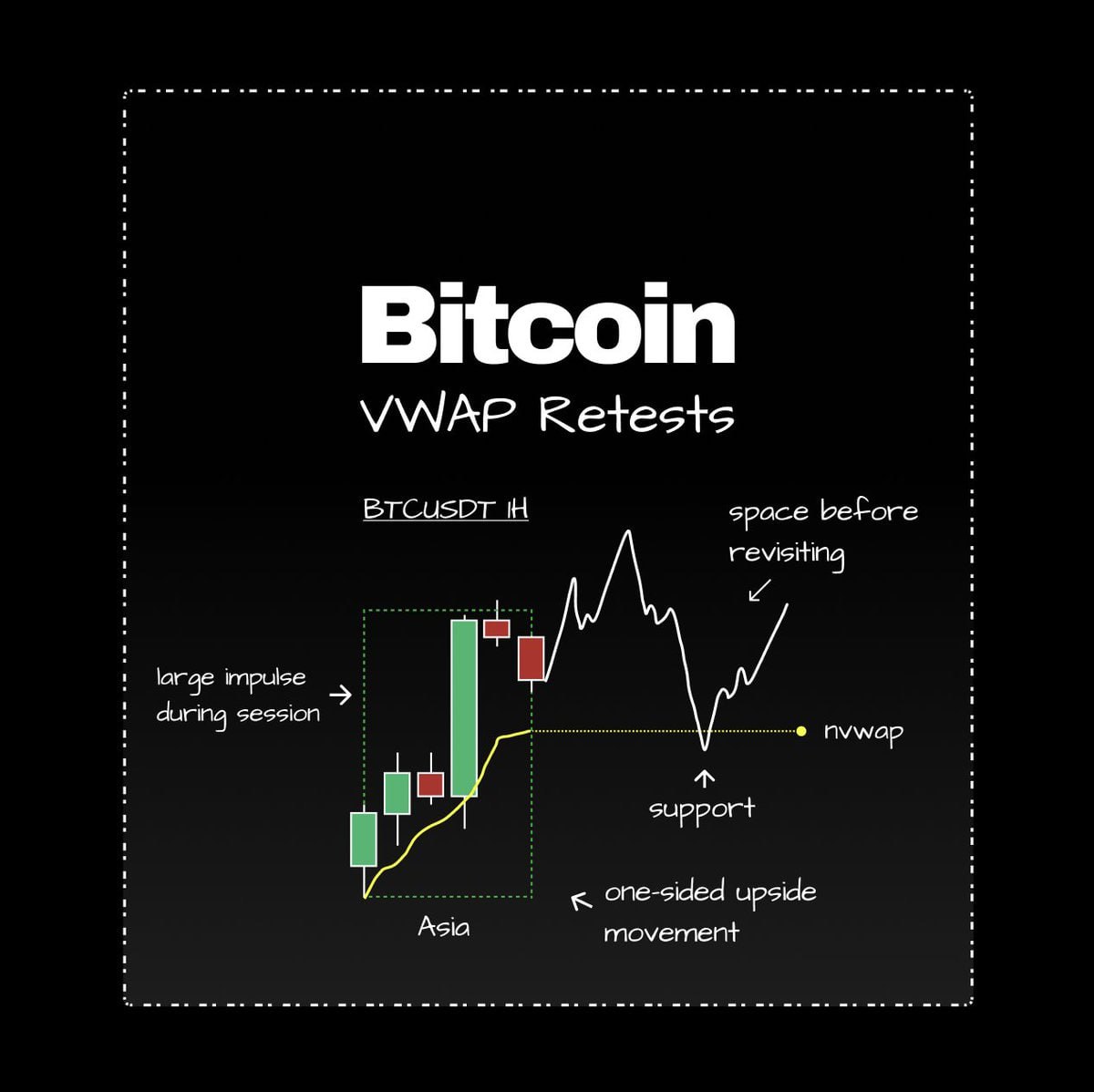

Session VWAP Retests

The VWAP levels from each session serve as price magnets. It is common for the price to retest these levels, particularly if they were significant in facilitating strong, one-directional price movements. Additionally, these VWAP levels can transform into intraday support or resistance zones.

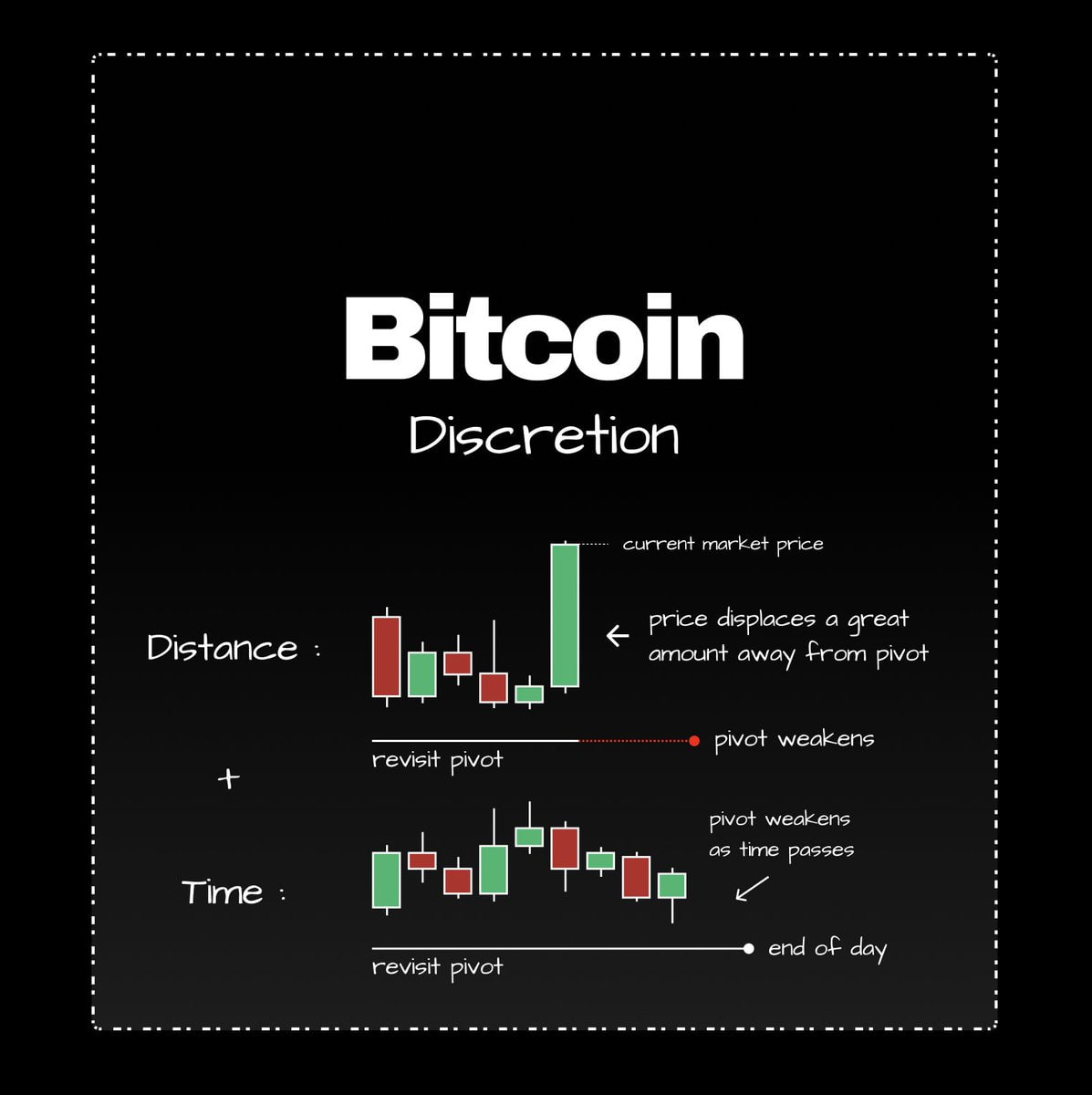

Discretion Over Stats

While statistical levels provide valuable guidance, they are not definitive. Over time, these levels may lose their relevance. Traders should consider factors such as distance and time to filter out less reliable levels. Not all support and resistance levels are equal, and exercising discretion is crucial.

Trading Bitcoin with session logic introduces a sense of order amidst market chaos. By anticipating price flow instead of merely reacting to it, traders can gain a strategic advantage in their decision-making process.

You may also be interested in: Massive Liquidation of ETH Shorts Looms as Price Nears $4000 – Market Reacts