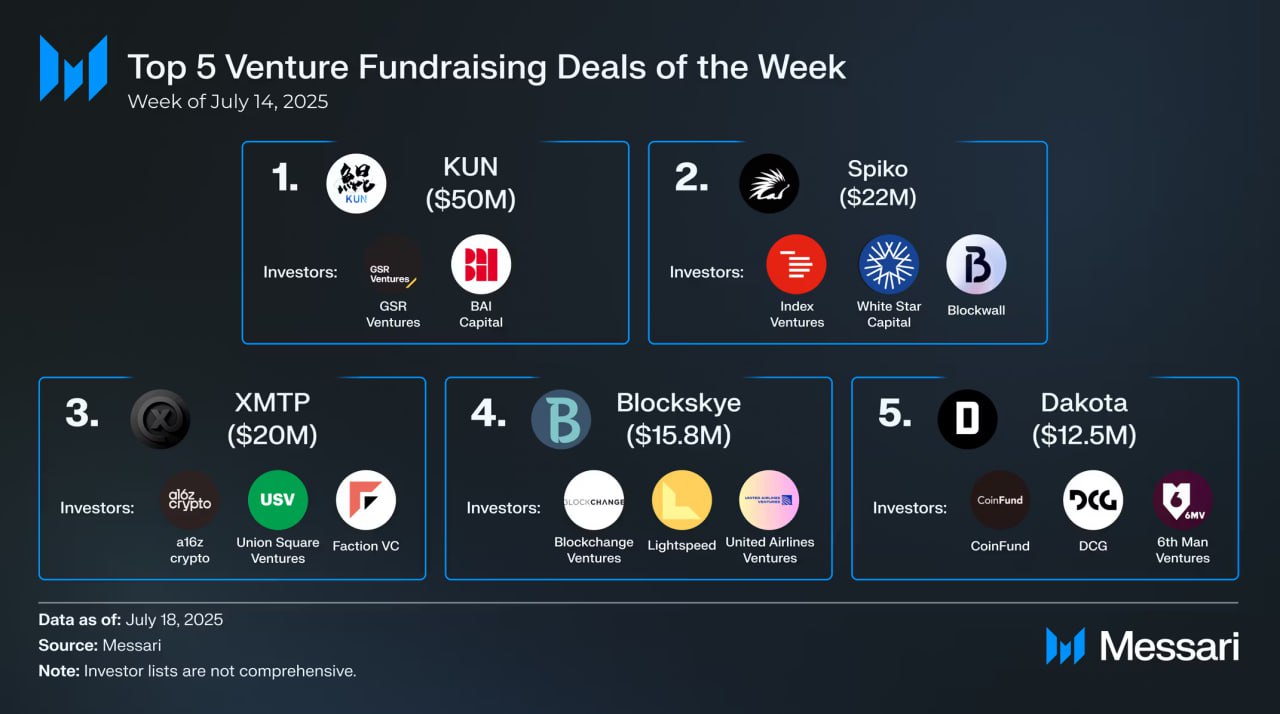

Crypto Venture Weekly Update: July 14–18, 2025

Last week, a total of $202 million was raised across 19 projects, with investments primarily directed towards stablecoins, crypto banking, DeFi infrastructure, and tokenized finance.

Top 10 Projects Overview

-

KUN ($50M, GSR Ventures, BAI Capital)

Asia-based platform for embedded finance and stablecoins, licensed in Hong Kong and Singapore, providing cross-border payments and on-chain B2B finance tools.

-

Spiko ($22M, Index Ventures, Bpifrance)

Tokenized money market fund platform with €400M AUM, offering on-chain T-Bill exposure for startups and SMEs, compliant and integrated with European custodians.

-

XMTP ($20M, a16z, USV, Coinbase)

Cross-chain messaging protocol facilitating wallet-to-wallet communications, notifications, and announcements, already adopted by apps like Lens and Farcaster.

-

Blockskye ($15.8M, United Airlines Ventures, Lightspeed)

Developing blockchain infrastructure for corporate travel, utilized by major airlines and agencies to automate settlement, invoicing, and policy enforcement.

-

Dakota ($12.5M, CoinFund, DCG)

Crypto-native B2B banking layer offering fiat rails, treasury tools, and compliance services for Web3 startups and DAOs.

-

AI Cross Matrix ($12M, Avalon Wealth Club)

Privacy-focused protocol enabling cross-chain, untraceable crypto transfers using zk tech to anonymize flows between chains.

-

fBTC ($10M, Galaxy Ventures, Mantle)

DeFi platform unlocking Bitcoin for staking, lending, and liquidity provision, aiming to create native yield products for BTC holders.

-

W3 ($7M, Framework Ventures, Blockchange)

Decentralized compute protocol empowering AI agents with off-chain workflows, verifiable compute, and token incentives for distributed AI infrastructure.

-

Football.Fun ($2M, 6th Man Ventures, Zee Prime)

On-chain football betting and prediction markets focusing on gamified speculation around global matches.

-

MoneyBadger ($400K, P1 Ventures)

South African QR-based crypto payments app for retail and e-commerce, operational with 60+ merchants in the pilot phase.

Real-world utility and crypto infrastructure projects are gaining traction, emphasizing stablecoin mechanisms, tokenized yield strategies, and off-chain computing solutions.

Powered by Trade Watcher

Related news: Reasons Why Most People Quit Before Succeeding